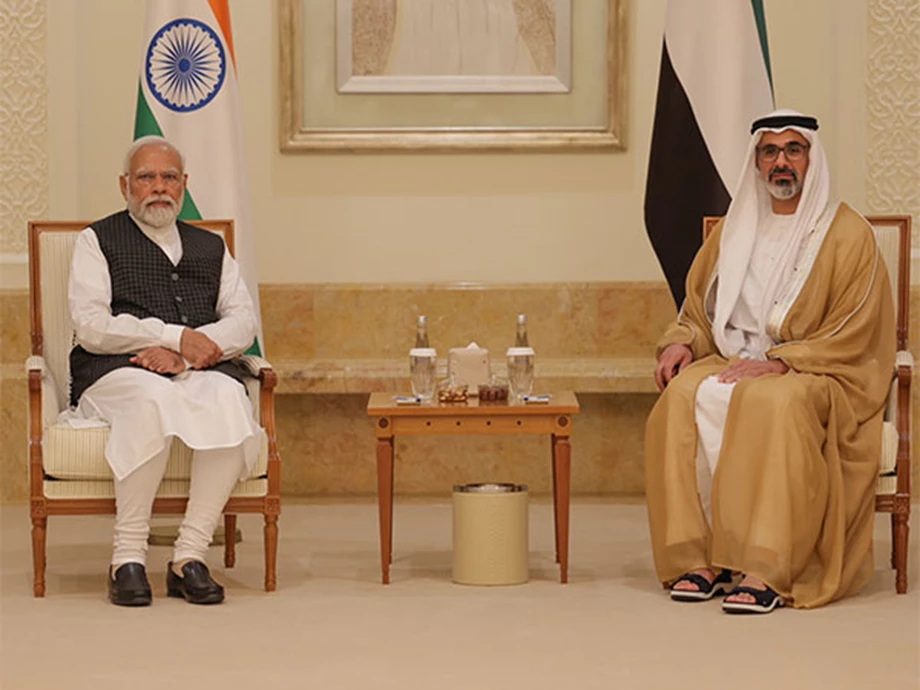

Dubai, UAE, July 14: Indian Prime Minister Narendra Modi’s visit to Abu Dhabi marked a significant milestone as India and the United Arab Emirates (UAE) solidified agreements to facilitate trade settlements in their local currencies, the Indian Rupee (INR) and UAE Dirham (AED).

In a joint effort to strengthen cross-border transactions, India and the UAE signed a Memorandum of Understanding (MoU) aimed at establishing a framework for utilizing local currencies.

Reserve Bank of India Governor Shaktikanta Das and Governor of Central Bank of UAE Khaled Mohamed Balama signed two MoUs to boost local currency utilization and integrate payment and messaging systems.

The agreement focuses on creating a Local Currency Settlement System, promoting bilateral transactions using the Rupee-Dirham, encompassing all current account transactions and permitted capital account transactions.

This move is part of India’s ongoing efforts to expand the international use of the Rupee. Over the past year, Indian authorities have actively encouraged global adoption of the Rupee, with the RBI announcing a mechanism for settling global trade in Rupees in July 2022.

Presently, India, being the world’s third-largest oil importer and consumer, pays for UAE oil in US dollars. The bilateral trade between India and UAE in the fiscal year 2022-23 amounted to $84.5 billion.

India aims to replicate such local currency arrangements with other nations, seeking to bolster exports amidst the backdrop of sluggish global trade.

Sources familiar with the matter revealed that India could soon initiate its first Rupee payment to Abu Dhabi National Oil Co (ADNOC) for UAE oil.

The Reserve Bank of India plans to issue guidance for banks regarding Rupee trade shortly, once initial challenges have been resolved.

Notably, the Gulf states, with their heavy reliance on food imports (accounting for 80-90% of their consumption), are striving to secure their supply chains.

In support of this cause, the United Arab Emirates has pledged $2 billion towards the development of “food parks” in India, aimed at addressing food insecurity in South Asia and the Middle East.

Both India and the United Arab Emirates have mutually committed to raising non-petroleum bilateral trade to $100 billion by 2030, as affirmed by India’s trade minister last month.

Moreover, the UAE serves as a crucial trading hub, facilitating access to African and European markets.

To foster the internationalization of the Rupee, India has taken several measures, including enabling external commercial borrowings in Rupees and encouraging Indian banks to open Rupee Vostro accounts for banks from Russia, Sri Lanka, Mauritius, and the United Arab Emirates.

Additionally, India has instituted measures to promote trade in Rupees with approximately 18 countries.

Such steps aim to reduce India’s reliance on foreign currencies, particularly the US dollar, for international trade and financial transactions, thereby enhancing economic sovereignty and mitigating exposure to currency fluctuations.